Income Investors May Find Closed-End Funds on Sale

Do you know the differences between open-end and closed-end funds?

This week, Craig Siminski, of CMS Retirement Income Planning, shares an article comparing the two:

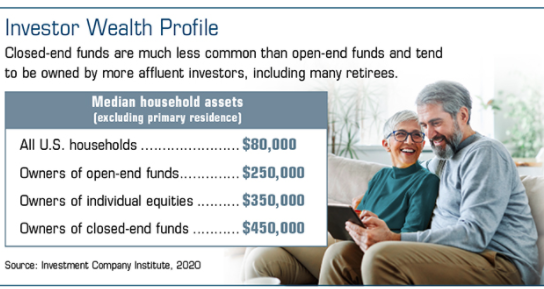

Most mutual funds are open ended, which means the investment company can issue and redeem fund shares to meet investor demand. By contrast, closed-end funds issue a fixed number of shares in an initial public offering (IPO), and thereafter shares are traded on an exchange.

Both open-end and closed-end funds may hold stocks, bonds, and other types of underlying investments. Unlike open-end funds, closed-end funds do not have to maintain cash reserves or sell securities to meet redemptions, so fund managers can invest in less-liquid securities. They can also use riskier leverage strategies, which can magnify a fund’s positive or negative returns and make them more volatile.

Closed-end funds are often designed to generate a steady income stream — called the distribution rate — that tends to be higher than what might be offered by an open-end fund with similar securities.

However, closed-end funds may be better suited for…

To Read the Entire Article, Please Click Here.

Craig Siminski is a CERTIFIED FINANCIAL PLANNER™ professional, with more than 22 years of experience. His goal is to provide families, business owners, and their employees with assistance in building their financial freedom.

Please let Craig know that the Green Bay News Network Sent You.