Schneider Community Credit Union Offering Money Back Savings on Auto Refinancing

Move Your Auto Loan, Get a 1% Cash Rebate*

Do you have an auto loan at another financial institution? See if you can save more by refinancing it with SCCU. Plus, they’ll give you a 1% cash rebate* when you do.

All they need is the contract that you signed. With their rates as low as 2.74%**, they will determine what savings that refinancing will bring!

Easy to See the Savings***

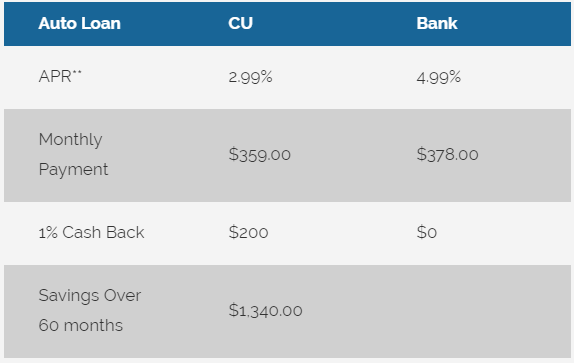

In the table below, you will find an example of a car loan for $20,000 where the bank was charging 4.99%APR. At SCCU, their rate was lower, and when they did the calculations, the monthly payment was less.

In addition, the member received a 1% Cash Rebate* which created a savings of $1,340.

Contact Schneider CCU for an appointment to review your current auto loan to see if they can save you money with refinancing! Plus, if you want to apply for another type of SCCU loan, switch to a better credit card, or need a personal loan to fit your budget, call them at (920) 499-4711 or (800) 236-0747.

Ready to apply? Click here.

*Cash incentive will be 1.00% of the loan proceeds, up to a maximum of $300 and will be paid at closing. Minimum loan balance is $10,000 and minimum term is 24 months. No cash out. Payment must be transferred from an SCCU Checking account. SCCU’s normal underwriting and processing guidelines apply. Loan must be transferred from another financial institution.

**Annual Percentage Rate.

*** Savings is calculated as 1% cash back of $200 on the $20,000 Vehicle Loan example. Comparison is provided as an example only.

All loans subject to credit approval. Please contact a SCCU representative for more details.